The “two sessions” — annual meetings of the National People’s Congress (NPC) and the Chinese People’s Political Consultative Conference (CPPCC) — just recently came to a close. If you’re an Israeli entrepreneur or policymaker, you probably should have been watching.

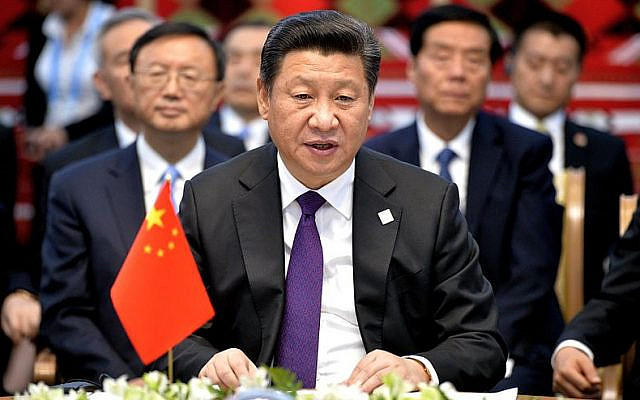

The “two sessions” are among the most important political events in China. The meetings serve as a window into what is happening in China and what can be expected. This includes decisions that will impact both domestic and international economies. This year is particularly notable because China announced its 14th five-year plan, which for the first time was directly led by President Xi Jinping. If Israeli businesses know where to look and what to look for, this plan can reveal new opportunities.

First and foremost, Israelis must understand that the Chinese take planning seriously, and this Five-Year Plan is about action.

The blueprints drawn up at this meeting indicate which geographical locations and sectors will receive increased investment and determine which industries and projects are national priorities. China’s highly sophisticated formula of state-enterprise cooperation means that these plans heavily influence both state-owned and private corporate business decisions. When Xi Jinping, The Chairman of “China inc.” speaks, his language generates movement.

For example, Xi’s October 2019 speech in which he declared blockchain a “core technology” was followed by numerous announcements of new blockchain research and funding initiatives: Shenzhen-based Hande Financial Technology Holdings pledged $1 billion for blockchain consortium development. Meanwhile, the Digital Currency Research Institute established a partnership agreement with telecom giant Huawei.

This phenomenon is not blockchain specific; it’s simply how China works. From semiconductors and artificial intelligence to green energy and agricultural technology: when the government calls, the whole of Chinese society answers. Locals understand that within China’s complex bureaucracy, giving the leadership what it wants enhances their prospects of moving up the proverbial food chain.

Notably, the messages conveyed in China’s plans are not only designed for domestic consumption. Those foreign companies able to decode these documents stand to reap significant rewards. When the Chinese government published a list of pharmaceuticals in short supply on the mainland, TEVA’s CEO Kåre Schultz identified the opportunity and expanded the pharmaceutical company’s presence to the Chinese market.

China-savvy entrepreneurs have identified the great value in products and sectors blessed by the government. They understand that Chinese officials are laser-focused on promoting President Xi Jinping’s policies, whether that be “Made in China 2025,” “Internet Plus,” or “the Belt and Road Initiative.” Those corporations that took notice of these plans were able to capitalize on China’s $1.4 trillion technology infrastructure build-out.

To succeed in China, Israelis need to understand the meaning of what is happening. For instance, knowing that China’s new tech infrastructure spree will rely more on local than national government spending is important. It means that by examining municipal government reports, entrepreneurs wishing to tap into China’s massive market potential can make a more calculated assessment regarding capital flows and identify which sectors are poised to benefit most.

China’s 14th Five Year Plan highlights which sectors will receive preferential funding and other forms of government support, as well as those industries encouraged by the party to look abroad for innovative solutions to solve the country’s many domestic challenges.

If you were watching this year’s two sessions, you would have noted some important developments.

For the first time in history, China dedicated a whole chapter in the Five Year Plan to technology that highlights the sectors that Beijing deems critical to its national development. According to the blueprint, China “will implement a series of forward-looking and strategic major national sci-tech projects in frontier fields of artificial intelligence, quantum information, integrated circuits, life and health, brain science, gene technologies and clinical medicine.”

The 14th Five-Year Plan reiterated government promises to open the telecommunications, internet, education, culture, and healthcare sectors to more foreign investment. Furthermore, China declared that foreign businesses doing R&D will now be eligible for tax breaks and that State-led science and technology programs would soon be available to foreign companies.

While these announcements are certainly promising, the plan also revealed some looming challenges.

China is expected to tighten the screws in the financial sector. More specifically, the plan has called for improving security-related mechanisms, including; the national security review of foreign investment, an anti-monopoly review, a list of technologies concerning national security, and its unreliable entities list. These signals are less encouraging for foreign companies but equally essential to understand if they want to assess the potential risks of entering the Chinese market.

In the wake of the COVID-19 pandemic, it should come as no surprise that China put healthcare front and center. This development positions Israel’s Healthcare Israel, a government organization, as an ideal partner for Israeli medical technology companies and healthcare providers. Understanding that working with an Israeli government organization can raise their profile in China, Israeli companies may well receive preferential placement to reap the benefits.

Notably, China’s push to achieve carbon neutrality by 2060 has also driven it to double down on its commitments to the Paris Agreement and the development of innovations in the clean-energy sector. Herein lies an opportunity for Israeli clean-technology companies to expand their operations to the Chinese market.

When it comes to China, Israel suffers from a handicap. The country lacks sufficient knowledge of China to fully capitalize on the opportunities that have emerged along with the country’s swift economic rise. Only a handful of academics in Israel specialize in China, and industry has only gotten a taste of what China has to offer since innovation cooperation began to boom in 2010. Considering that China is the world’s second-largest economy and an emerging superpower, bodes badly for Israel’s ability to capitalize on the abundance of opportunities China presents.

Israel desperately needs to enhance its China capacity. This is where Israeli policymakers step into the equation.

In their search for inspiration, they could look to countries like Australia, where the government understood there is a greater need for China knowledge across the private sector and acted. Canberra addressed the need by establishing a “doing business in China” initiative designed to help Australian companies identify opportunities, manage the risks, and provide best practice guidelines regarding working with China. While diplomatic tensions between Australia and China have reached unprecedented heights, initiatives like “doing business in China” continue to help businesses navigate this increasingly uncertain environment.

The window of opportunity will eventually close as China pushes to achieve self-reliance across multiple critical sectors. For now, the ability to tap into China’s massive market potential still exists. But Israelis are leaving money on the table by persisting in viewing the country as merely another big emerging market. China does things differently, and Israeli entrepreneurs would do well to learn how to “read the tea leaves.” A careful reading of China’s 14th Five Year Plan is a good place to start.

This article was originally published at The Times Of Israel